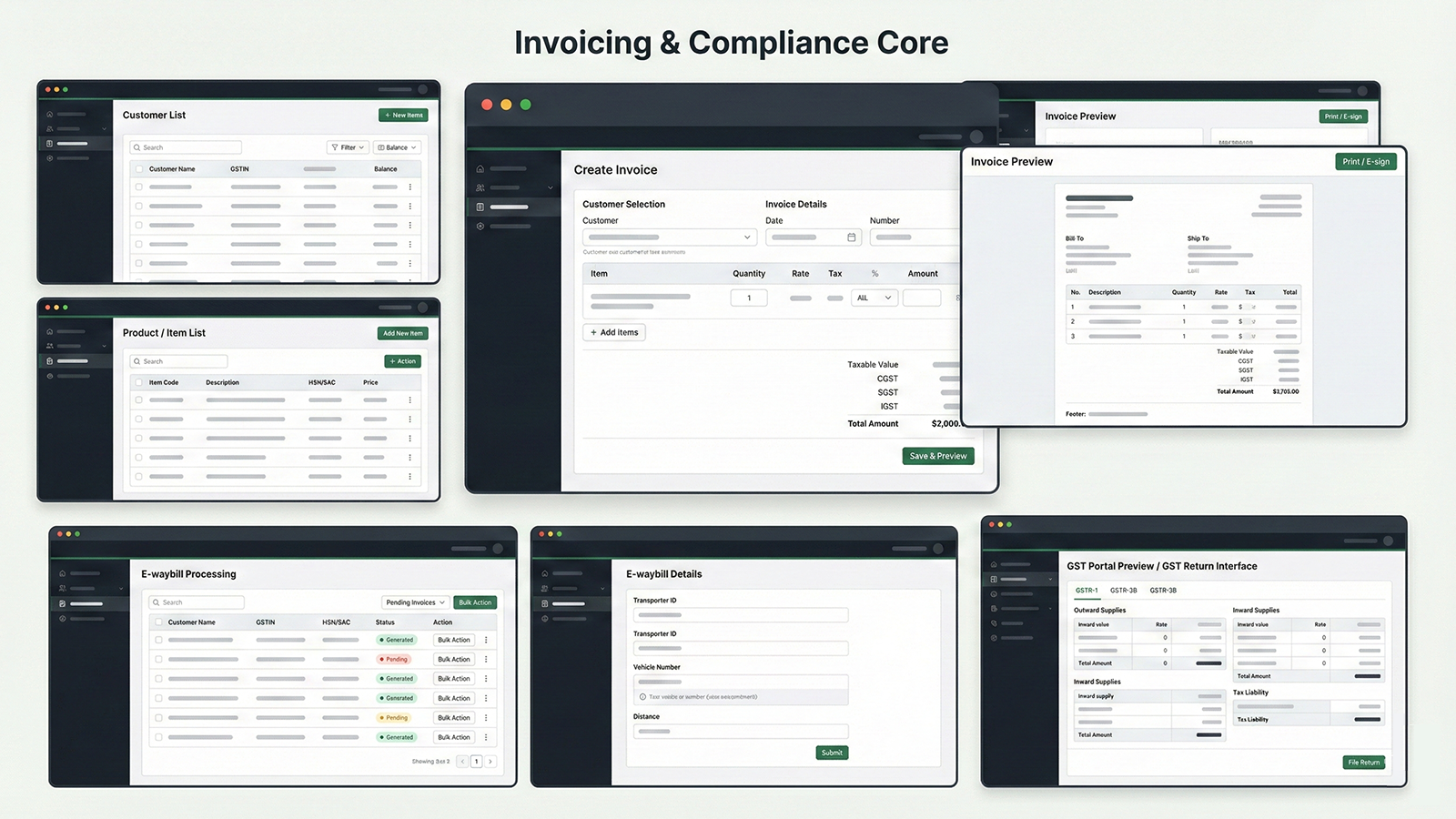

Invoicing & Compliance Core

A billing and compliance engine for recurring business operations — customer/product masters, invoice creation, previews, and GST/e-waybill readiness.

Invoices that match the way businesses actually bill.

Invoicing becomes chaotic when billing rules change per client, per tax, or per logistics flow. This core is designed for predictable invoicing — with clean masters, invoice generation, and compliance-aware steps.

Whether you need internal billing discipline or a compliance-ready foundation, the system keeps the workflow structured and auditable.

System Modules

A solid base that can integrate with your existing compliance workflow.

Master Data

Clean customer and product records with tax fields, pricing tiers, and search-friendly lists.

Invoice Builder

Invoice creation with line items, automated tax calculations, discounts, and preview-first validation.

E-waybill Flow

Structured steps to prepare e-waybill details, vehicle numbers, and export formats.

GST Readiness

Data alignment for portal workflows, tax summaries, and compliance operations.

Reporting

Customer-wise sales reports, date-wise summaries, and export options for accounting.

Audit Trails

Traceable actions, role-based controls, and consistent output formats for external audits.

From masters → invoice → compliance

The UI is built to reduce mistakes: validate, preview, then commit. Compliance steps remain structured and repeatable.

Want to see it mapped to your workflow?

We’ll walk through the modules, the user journeys, and the deployment approach — then recommend the cleanest path to adopt it for your operations.

Direct access to the partners. No sales layers.