The Constraints

-

Billing Complexity

Support for hybrid models (Retainer + Hourly Overage) which standard tools couldn't handle.

-

Dunning Logic

Needed an automated but polite way to chase late payments without ruining client relationships.

-

Data Security

Handling sensitive financial data required bank-grade encryption and access controls.

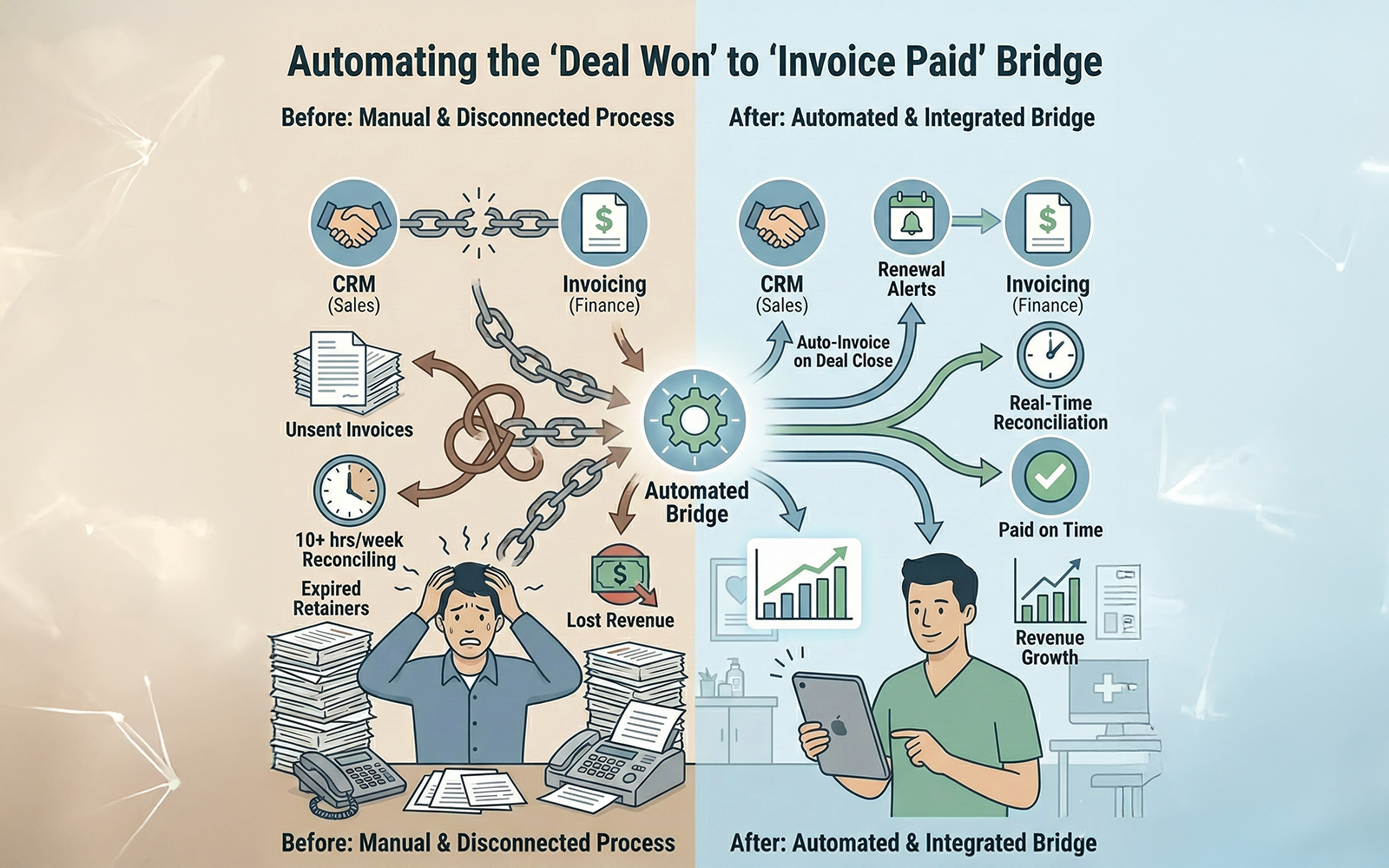

The Approach

Unified Data Model

We abolished the distinction between a "Lead" and a "Client." Instead, we built a lifecycle model where a signed contract automatically triggered the creation of the billing schedule, removing the manual data entry step entirely.

Automated Billing Logic

We engineered a custom state machine to handle recurring billing. It automatically calculates pro-rata adjustments, generates PDF invoices, and emails them on specific dates.

Cashflow Dashboard

Instead of a standard list of invoices, we designed the dashboard around "Cashflow Forecast." It visualizes incoming revenue vs. outstanding debts instantly.

Smart Compliance

We integrated a tax-calculation engine that automatically applies the correct VAT/GST based on the client's location, solving a major compliance headache.

The Outcome

Reduction in average unpaid invoice lag time.

Accuracy in automated tax compliance across 4 jurisdictions.

Saved per week per founder on manual administration.

Eliminated churn caused by missed renewal follow-ups.

"Cash flow is an experience problem, not just a finance problem. Making it visible makes it manageable."