The Constraints

-

Fragmented UI Ecosystem

Multiple products shipped with different components, patterns, and terminology — creating user confusion and rework.

-

Compliance-Heavy Workflows

KYC/AML checks, approvals, and audit trails had to be visible and verifiable without slowing daily operations.

-

Performance + Latency

Users worked across high-volume dashboards where slow rendering and heavy bundles directly impacted decision speed.

-

Cross-Team Release Independence

Teams needed autonomy to ship features without breaking shared UI contracts or creating brand drift.

The Approach

Design System Governance

We created a unified component library with clear usage rules, accessibility standards, and versioned releases — turning UI into infrastructure rather than “screens.”

Micro-Frontend Foundation

We established a micro-frontend architecture so domain teams could deploy independently while sharing authentication, navigation, and the design system safely.

Compliance-First UX Patterns

We redesigned KYC/AML and approval flows around clarity and traceability — with structured decision states, audit-ready timelines, and error-proofed forms.

Performance Discipline

We reduced bundle weight through modular loading, shared UI primitives, and route-level optimization — improving responsiveness on data-heavy screens.

The Outcome

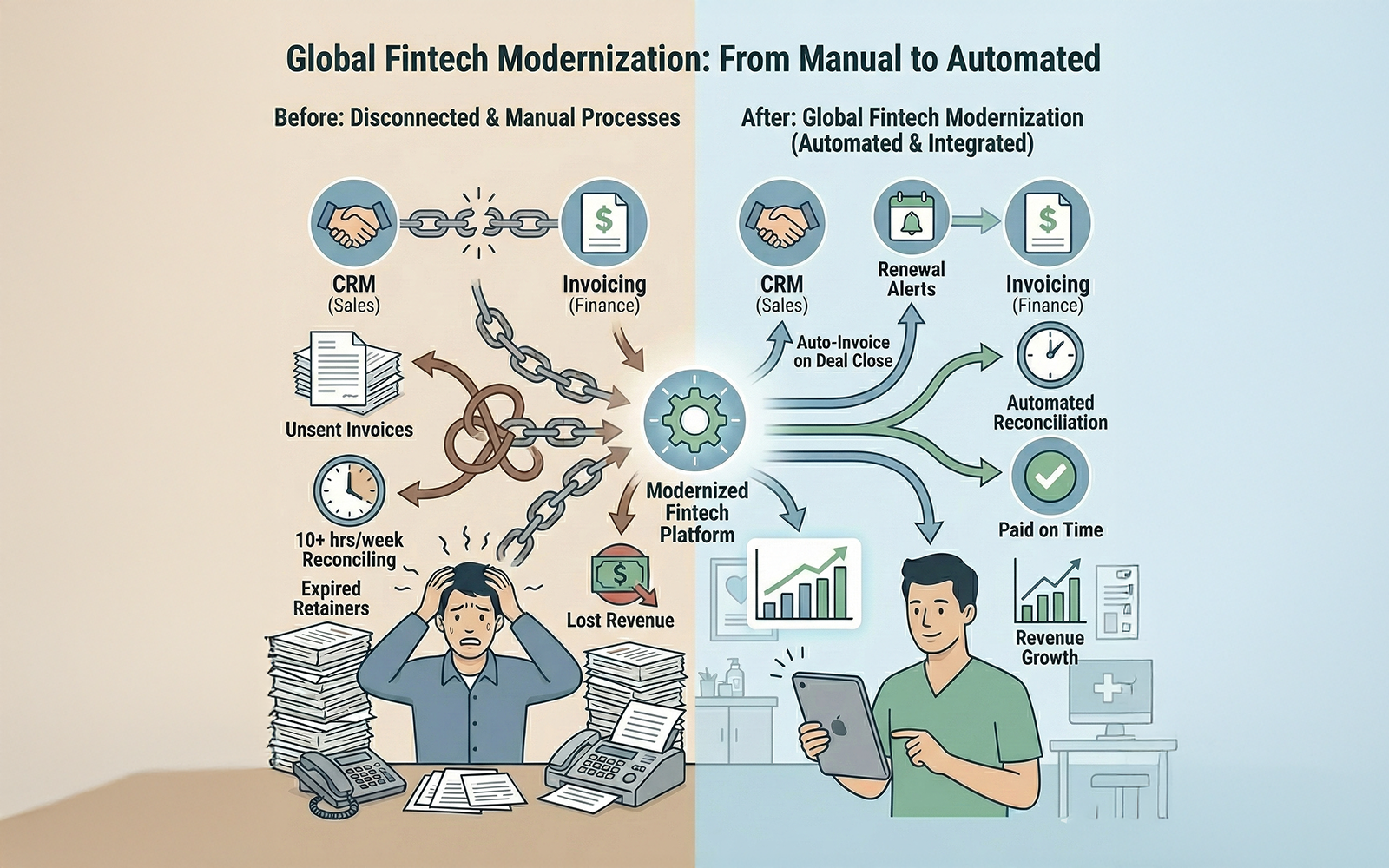

Reduction in average unpaid invoice lag time.

Accuracy in automated tax compliance across 4 jurisdictions.

Saved per week per founder on manual admin.

Churn due to "forgotten" renewal discussions.